CARTA: THE END OF THE BEGINNING

March 31st, 2020 was my last day at Carta. I am immensely grateful for the opportunity Henry afforded me when he made a twenty-five year old with minimal (read almost none) operating experience an executive at Carta. After serving in the trenches with Henry for thirty-eight months and becoming his longest serving deputy, it’s time for me to move on. Here is the story of how I ended up at Carta and my time there. What’s next? That is a tale for another day.

What is eShares?

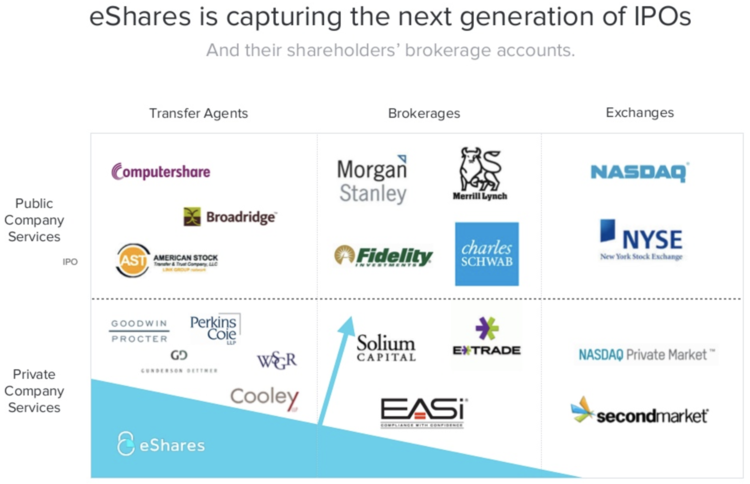

In 2014 a friend shared a deck with me from a small company in Mountain View called eShares Inc. The deck opened by posing a simple question: “What is eShares?”. I did not have to wait long for the answer. On the next slide there was a diagram that represented one of the most audacious visions I had encountered in my short career as a tech investor. In a single slide, Henry Ward had succinctly laid out a multi-decade roadmap that called for financial infrastructure in the US to be rebuilt bottoms up starting in the private markets.

The problem Henry Ward was solving resonated with me. I had seen up close that legacy financial markets and financial infrastructure was set up to favor banks and institutional investors. I had watched my parents almost get wiped out during the Great Recession after being coerced by a bank to switch a favorable loan into an unfavorable one. The pressure of this almost broke them financially and mentally. It was therefore evident to me from that point on that a behemoth sized opportunity existed to rebuild the financial world… one startup at a time.

As I spent more time thinking about the deck, Carta appealed to me because it had the opportunity to solve three meaningful problems:

Rebuild Financial Infrastructure: Legacy infrastructure had evolved piecemeal over a period of fifty plus years in the US. Companies like Charles Schwab and ComputerShare started as services businesses then utilized technology for efficiency. Had they started when most Americans had a computer in their pocket, they would have been built differently. Navigating financial markets through legacy infrastructure is expensive, time consuming, and confusing. It makes no sense that transfer agents, brokerages, investor communications, custodians, exchanges, etc. are fragmented. Carta has an opportunity to rethink this infrastructure from first principles, build it in the private world, and then go after public market incumbents.

Democratize Private Markets: It’s not a secret that since 1998 the number of public companies in the US has halved. Bad policy (Sarbanes-Oxley), unforeseen consequences from relatively good policy (the Jobs Act), and the flight of capital from low interest and underperforming markets, created an environment where companies could stay private almost indefinitely.

Reduce The Cost of Capital for Entrepreneurship: If more capital can access previously illiquid markets in a fair and transparent way, then the cost of starting and scaling a company should go down. As more capital entered previously illiquid markets these markets would become more liquid.

If Carta was successful, it would make a dent in the universe. That was the type of company I wanted to partner with. With that I cold emailed Henry.

The Secret

Henry and I traded emails for almost a year before meeting in person. He may have been skeptical of VCs at this point (who could blame him after what he went through in the seed & series a) so I had to keep “providing value” until he was sure I wasn’t an imposter.

When we eventually met it was clear he was trying to feel me out. He started by throwing some softball questions at me and listened intently to what I had to say. He seemed less interested in the actual answer I gave and more interested in the thought process behind it. It was evident to me early in our conversation that Henry was different – for one he was the first founder of the thousands that I had met to apply the socratic method. We went back and forth until finally we arrived at the ultimate question: “What does the world look like if we win?”. It was obvious Henry had asked this question dozens of times before, yet the tone in which he asked suggested no one had delivered a satisfactory answer yet. Without hesitation I responded “You’ll make illiquid markets liquid.” I could tell by the pleasantly surprised look on Henry’s face I had caught him off guard. At that moment, we were bonded by a shared sense of purpose. I knew his secret. I knew the secret.

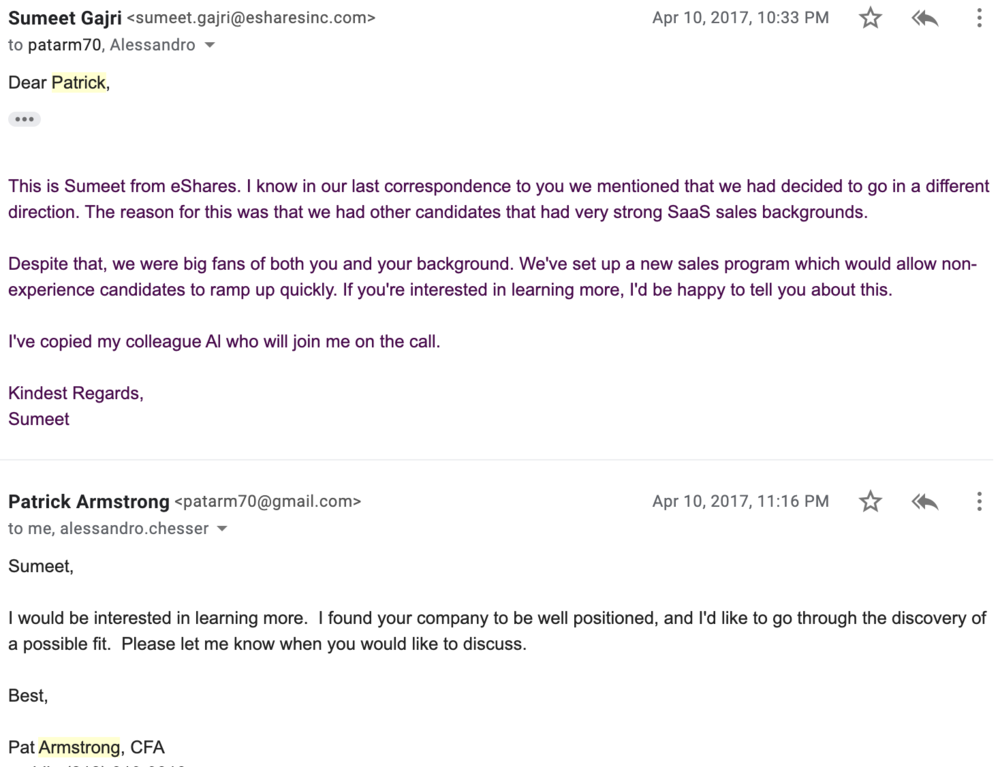

We immediately started communicating regularly and spending time together discussing problems Carta was facing in scaling – chiefly building its go to market engine. What became apparent was that Carta could only get to the secret if it built a sustainable software business first. It was during one of our conversations when Henry flagged specific growing pains in transitioning to a SaaS business and finding leaders who could help Carta that I had revelation – why not join Carta? When Henry paused I spontaneously said “These problems don’t sound so difficult. What if I were to join for three months, not take a salary, solve the problems, and then move on?”. In return I asked for the ability to buy my stock upfront. Henry was intrigued and said he’d think about it and get back to me. (below is part of our follow up email chain)

Things came together quickly and we ended up agreeing on an eleven month term. The goal of working together was to move Carta closer to being able to work on the secret. We mutually agreed that to get there we needed to achieve enough market penetration and that would only come via building a strong go to market engine. We needed enough critical mass within the startup ecosystem that we would be able to move the market in our favor.

Three Years Later

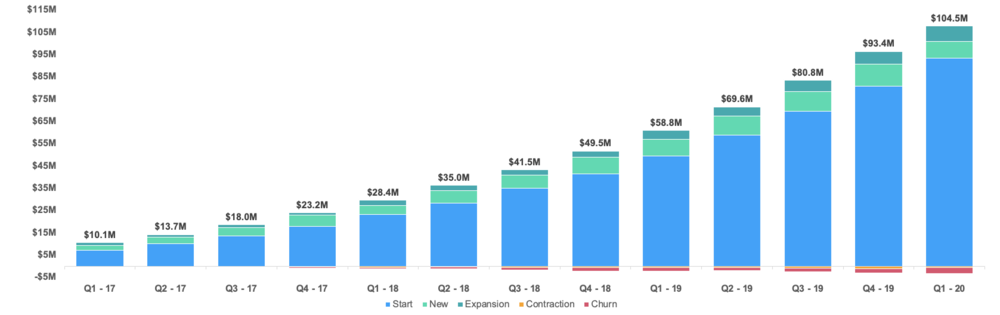

Over the last three years we accomplished a lot. We figured out how to scale go to market; we went from a single product company to multiproduct; our second product got to $20M in revenue in less than half the time of captables; we launched our first banking product; we opened offices in Salt Lake, New York, New Jersey, Waterloo, and Sydney; and we added hundreds of new Cartans to the team. The progress we made was noticeable and measurable. Revenue grew almost 15x and valuation over 40x.

That said, I’d be lying if I said everything was as up and to the right as these charts. While they are directionally accurate, they miss the steep peaks and troughs you experience when company building. They ignore the times I thought I was going to get fired in the early months for not being good enough; they miss the bad decisions we made that slowed growth down; they miss the bad hires that set us back; and they miss the emotional and mental toll that you have to power through. Most of all, the charts miss the true leading indicator of Carta – our people.

At their core, companies are groups of people who come together to solve a problem. The real joy of working at a company like Carta for three years is working alongside amazing people who are driven by the same mission as you. The real reward for me from the last three years is everything my colleagues taught me. The story of the last three years of Carta is really an amalgamation of the stories of every Cartan. I wish I could name every person who impacted me. There are hundreds of amazing Cartans. I’m going to share the stories of a few who impacted me personally and what they taught me that I’ll keep with me going forward.

Alessandro Chesser – Al taught me pedigree doesn’t matter. In his own words, he took almost six years to graduate from San Jose State with a two point something and started his career as a teller at Bank of America. Yet, he is one of the greatest salesmen and inspirational leaders I have met. What he lacks in GPA he makes up for with his whip-smart sales acumen, his heart (which is like that of a lion), and his ability to make others want to follow him. Al can outgun the competition like no one else at Carta.

Patrick Armstrong – Pat taught me that it is never too late (or early) to take risks and reinvent yourself. We originally rejected Pat because he did not have experience doing SaaS sales. I have a habit of skimming rejected resumes and when I saw Pat’s resume I was taken aback. Pat graduated from Columbia University, was the starting center on the football team for three seasons, and worked in various equity trading roles on Wall Street for twenty-two years after graduating. I found it hard to believe that there wasn’t a place for someone like Pat at Carta as an entry level account executive which is why I immediately reached out and tried to rectify what I saw as a glaring mistake.

My first conversation with Pat was inspiring. By the time I got off the phone with him the first thing that went through my head was: if this guy can sell software, he could lead our public sales team when we get there (at the time the product was a few years out). Thankfully Pat decided to join Carta and was one of our top three salespeople in 2017, 2018, and 2019. In January 2020 he was promoted to be the Director, Public Sales at Carta.

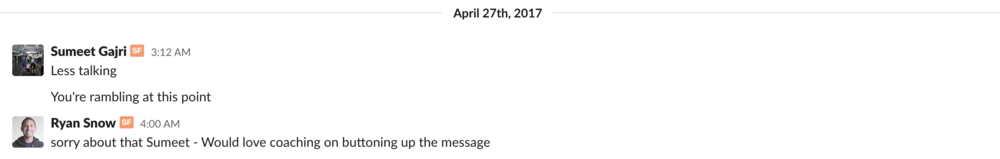

Ryan “The Snowman” Snow – Ryan taught me that slope is more important than y-intercept. He had recently transitioned from being the #2 in Index Ventures back office to work on the investor team at Carta. His first six months had been bumpy due to the initial role not being a good fit. We needed someone to sell our investor product, which was still in beta, and Ryan stepped up. Unfortunately, he had no prior sales experience and initial sales failed to materialize. That didn’t deter Ryan though – he was a fast learner and started asking for help and feedback. I was happy to oblige and started working closely with Ryan.

Ryan applied feedback well and the change in his production was noticeable meeting to meeting. In 2018 and 2019 Ryan Snow was Carta’s best salesperson and single handedly brought in over five percent of Carta’s new revenue each year. He is also one of two people I credit for encouraging me to look into pivoting our investor business towards fund admin – this accounts for over 20% of Carta’s revenue today.

Paul Philips, Philip Haynes, and Rob Hodgkinson – Collectively they taught me that hacker culture is real and the best technology is more likely to be built by a small team obsessing over a problem than by an army of engineers. I’m glad we crossed paths and will remember our short time together fondly.

Carta is full of amazing people like Alessandro, Patrick, Ryan, Paul, Philip, and Rob. It is the people who are the leading indicator at Carta and the reason the graphs above were possible in the first place.

I was at Carta longer than I ever intended. More than twelve times longer than I initially offered and more than three times longer than what we initially agreed. What happened? Quite simply two things. First, the people around me inspired me everyday and made me want to keep investing time and money in Carta. Secondly, I wanted to make sure when I left the next phase of Carta would be within reach.

The End Of The Beginning

If companies are really the stories of people then there has to be a central protagonist who binds the plot together. In Carta’s case that person is Henry Ward. It may sound ridiculous today but when I was thinking about joining Carta in 2016 most investors I knew warned against going to Carta. They told me the market was too small and everyone on Sandhill Road had passed on the seed, Series A, and Series B. They also warned me against working with Henry – he was a sandal wearing eccentric with a propensity to shoot from the hip.

While I listened to the feedback carefully, I did not blindly follow it and instead developed my own perspective. Being weird or different is not a bad thing. After all, Don Valentine purportedly said Steve Jobs “smelled odd and looked like Ho Chi Minh” when he first funded Apple. My counternarrative on Henry is that he knew the secret and was building Carta to solve for it from day one. I knew every other cap table software company in the market (public and private) and they were all building vertical software for cap tables in the cloud. Carta on the other hand was building a network around the ownership graph with the idea that this could one day form the basis of a platform that could converge private and public markets. Henry envisioned Carta bringing liquidity to illiquid markets.

Henry and I began laying the groundwork for liquidity in late 2018 when we realized we were a year away from this point. The challenge was simple. Assemble a product and engineering team capable of building a massively scalable trading system on top of Carta – we called it CartaX. We flew around the world and put together the best team possible. If there were forty people in the world who could build CartaX, we needed to make sure at least half of them came to Carta. We sourced and recruited locally in New York and San Francisco, and as far afield as Australia and Taiwan. We hired theoretical physicists, market design experts, national puzzle solving champions, SEC enforcement lawyers, the team who built – IEX – the last new national securities exchange in the US, and the entire founding team that built the world’s most ubiquitous market management software.

That team is now in place, and CartaX is now hurtling towards launch. As of March 2020, over one-third of all vc-backed companies in the US use Carta and we’re adding one percent of the market each month. We reached critical mass. The foundation for the coming decades of Carta is in place. This is the end of the beginning. Our move away from solely getting the world to accept our eShares as being representations of real world assets and towards building a functioning financial market for the private world.

One Last Thing

I am glad I did not listen to the naysayers. I can tell you after fighting alongside Henry in the trenches for over three years that he is truly one of the most remarkable founders you will meet and partner with. That doesn’t mean working with him is easy – far from it. It also doesn’t mean he is perfect or always right – he’s not and admits as much. That said, he will challenge you, he will push you, and he will force you to become the best version of yourself. Yes – it was chaos. Yes – it was emotional. And yes – it led to our first grey hairs. Despite that, we went from business partners to lifelong friends. In the end, partnering with Henry and the team at Carta was the ride of a lifetime. I leave Carta knowing the secret is almost real… Liquidity is coming.